Leveraged Buyout Advisors

Leveraged Buyout Financing (LBO)

We serve as a leveraged buyout advisor to profitable, private companies. Using Lantern's consulting services to achieve leveraged buyout (LBO) financing, our clients achieve operating and financial control of the company either upon completion of the leveraged buyout or over time as the leveraged buyout financing is repaid.

Leveraged Buyout Consulting

The leveraged buyout consulting practice within Lantern Capital Advisors helps companies access the capital to achieve leveraged buyout financing (LBO) for their leveraged buyouts on primarily an all debt basis.

Lantern Capital Advisors

Based in Atlanta, Lantern Capital Advisors is a consultant and advisor and successfully executes leveraged buyouts (LBOs) for growing companies. We develop business plans and raise capital to secure leveraged buyout financing for leveraged buyouts.

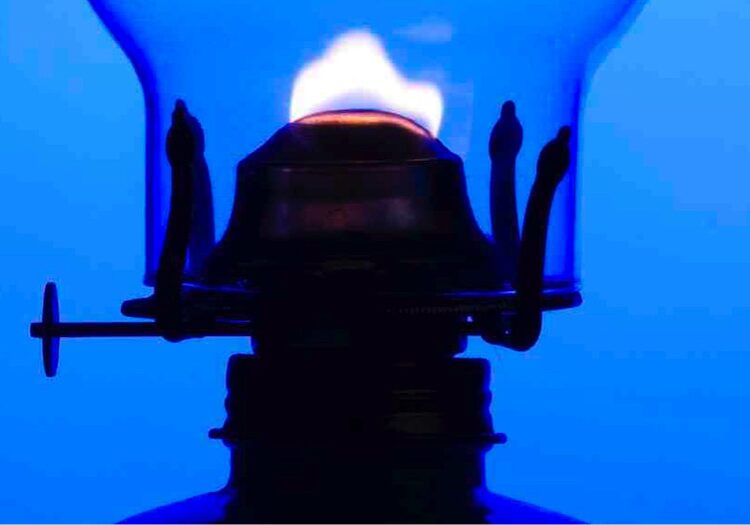

Leveraged Buyout Advisors: Lantern Capital Advisors

Alternative Investment Banking Services For High Growth Companies

What we do: Corporate Business Planning and Capital Raising

Just like investment banking firms, Lantern Capital Advisors writes business plans with financial models and raises capital from institutional lenders, equity firms, and specialty debt providers, except...our team of consultants work to successfully secure business financing for our clients on an hourly fee basis. Our typical business plan takes two to four weeks to complete prior to distribution to institutions for feedback. Based on the financing required, and the funding sources due diligence requirements, clients can expect to close on funding in three to four months post project kick off.

Corporate Financial Consulting With Lantern Capital Advisors

WE ARE NOT A BROKER. WE ARE NOT AN INVESTMENT BANKING FIRM. We are a corporate financial consulting firm that specializes in corporate financial consulting, specifically geared towards raising capital for established growing companies. We don’t accept referral fees, broker fees, or equity as any compensation from any client or institution.

Our Services Offerings Include:

- Corporate Financial Planning

- Refinance Company Debt

- Acquisition Financing

- Management Buyout and Leveraged Buyout

- Raise Capital

- Business Plans

Our methodology is very efficient, effective and proven. We can very quickly package a company for the market, confidentially solicit institutional interest, and negotiate proposals – clients can expect term sheets as soon as three to five weeks after engaging Lantern to manage the corporate debt refinancing or raising capital process, and financing in as little time as eight weeks.

We pride ourselves on being FAST, TRUSTED, and COST EFFECTIVE.

It is no surprise that a growing company may be alarmed that the financing that they have in place today may not available tomorrow. Established companies may want to consider refinancing corporate debt facilities should they feel their current lenders credit capabilities are compromised, either now or by the time those lines mature.

Lantern helps companies CONFIDENTIALLY explore capital raising and corporate debt refinancing alternatives in order to replace current institutional lenders, management buyout opportunities, acquisition finance strategies, or raising growth capital in order to support the business plan.

Lantern Capital Advisors believes that a company’s best interest is to look for and secure financing separately from (and not alongside) the current lender, as the company can time the transaction on their terms and not based on the broker dealer ‘referral fee’ protocol.